When Is an Estate Administrator Needed?

1) When an individual passes away:

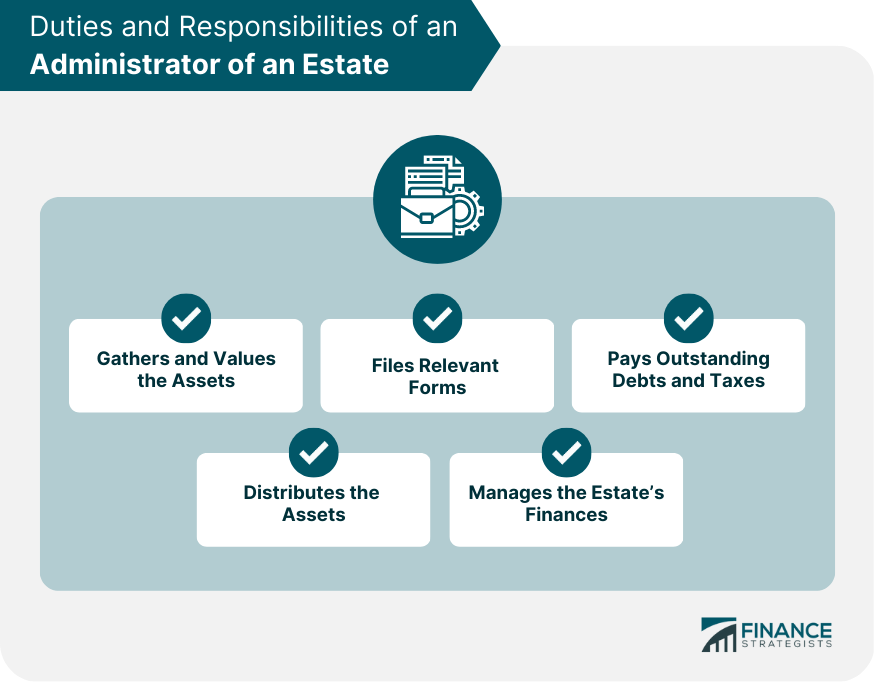

Upon the death of an individual, estate administration begins. This process involves managing and distributing the decedent’s assets, paying off debts and taxes, and ensuring the proper transfer of property to beneficiaries or heirs.

4) When there are complex assets or financial matters:

Estate administration may be necessary when the deceased person had intricate financial holdings, such as businesses, investment portfolios, or real estate properties. It involves valuing, managing, and transferring these assets in compliance with applicable laws and regulations.

2) When there is no valid will:

If the deceased person did not leave a valid will or trust, their estate will go through the probate process. Estate administration becomes necessary to determine how the assets will be distributed according to the laws of intestacy.

5) When disputes or challenges arise:

In some cases, disputes may arise during the estate administration process. This can include challenges to the validity of the will, disagreements among beneficiaries, or claims against the estate. Estate administration is required to address these issues and resolve them through legal proceedings, if necessary.

3) When there is a valid will:

Even if a will exists, estate administration is still required to carry out the instructions outlined in the document. The executor named in the will is responsible for managing the estate, fulfilling the decedent’s wishes, and overseeing the distribution of assets to the designated beneficiaries.

It’s important to note that estate administration procedures can vary depending on the jurisdiction and the specific circumstances of the estate. Seeking guidance from an attorney or a qualified estate administrator can provide tailored advice based on individual situations.