What Is The Value Of Estate Executor Services?

In summary, estate executor services provide expertise, relieve burdensome administrative tasks, ensure compliance with legal requirements, facilitate efficient asset management and distribution, and provide conflict resolution support. By entrusting the responsibilities to a professional executor, families can navigate the complexities of estate administration with confidence and peace of mind. Here are some key values of estate executor services:

1) Expertise and Knowledge:

Estate executors possess the necessary expertise and knowledge to efficiently navigate the complex process of estate administration. They are familiar with the legal requirements, documentation, and procedures involved, ensuring that the estate settlement is handled properly.

5) Timely Distribution of Assets:

One of the primary roles of an estate executor is to ensure the efficient and fair distribution of assets to beneficiaries according to the deceased person’s wishes as outlined in their will or estate plan. Executors handle the process of asset valuation, debt settlement, and asset distribution, minimizing delays and disputes among beneficiaries.

2) Minimization of Stress and Burden:

Dealing with the responsibilities of estate administration can be overwhelming, especially for grieving family members. Estate executors assume the burden of managing administrative tasks, allowing the family to focus on emotional healing and personal matters during a challenging time.

6) Conflict Resolution:

In cases where conflicts or disputes arise among beneficiaries, an estate executor can act as a neutral party to facilitate communication, mediate disputes, and help find mutually agreeable solutions. Their objective perspective can help reduce conflicts and preserve family relationships during the estate settlement process.

3) Proper Asset Management:

Executors are responsible for managing and safeguarding the assets of the estate. They ensure that assets are appropriately valued, protected, and accounted for throughout the administration process. This includes tasks such as collecting income, paying bills, and managing investments, providing peace of mind to the family.

7) Estate Tax Planning:

Executors can provide valuable guidance and strategies to minimize the estate’s tax liability. They work closely with tax professionals to identify potential tax-saving opportunities, ensure accurate reporting, and take advantage of applicable deductions or exemptions, ultimately maximizing the value of the estate for beneficiaries.

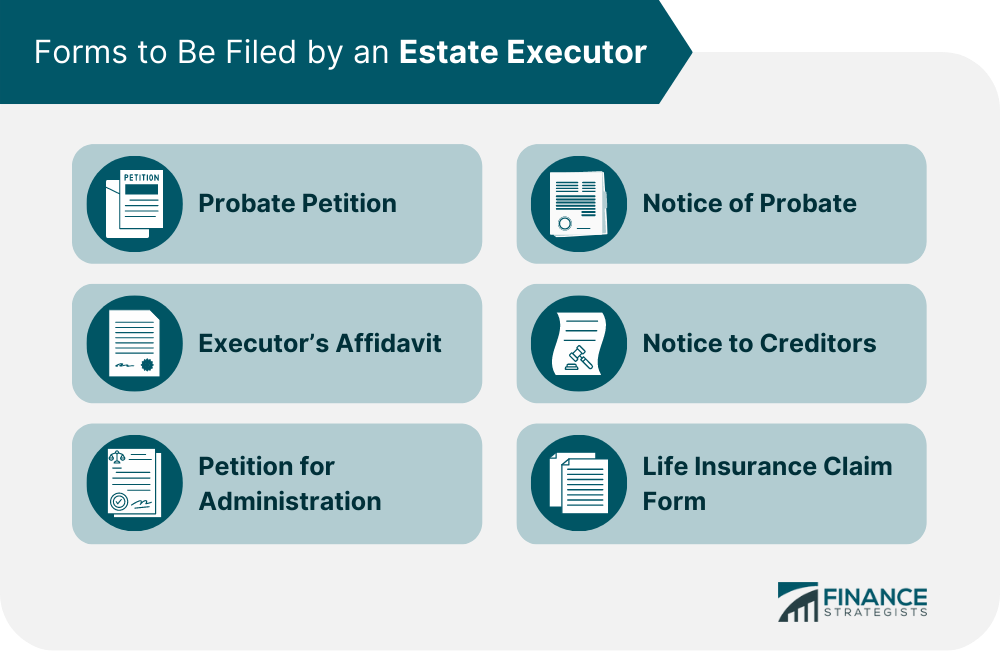

4) Compliance with Legal Requirements:

Executors have a thorough understanding of the legal obligations and requirements associated with estate administration. They ensure that all necessary legal documents, filings, and notifications are completed accurately and in a timely manner, reducing the risk of legal complications.

8) Professional Accountability and Oversight:

As fiduciaries, estate executors are held to a high standard of professional accountability. They are legally bound to act in the best interests of the estate and beneficiaries, ensuring transparency and adherence to ethical standards throughout the administration process.